Selling prices on Belgian M&A market keep on rising

Not only the number of deals, but also the selling prices kept on rising during 2017 for the fifth year on a row, as resulted from the yearly interview by Vlerick Business School, M&A Monitor 2018, of more than 150 M&A professionals, amongst which private equity, vrokers, bankers and corporate finance advisors.

The demand is higher than the current offering and the competition increases: the candidate buyers have a lot of cash and economic optimism. Also an increasing number of foreign players show interest in the Belgian companies, which was also confirmed during the latest M&A Worldwide Convention in Amsterdam in April 2018.

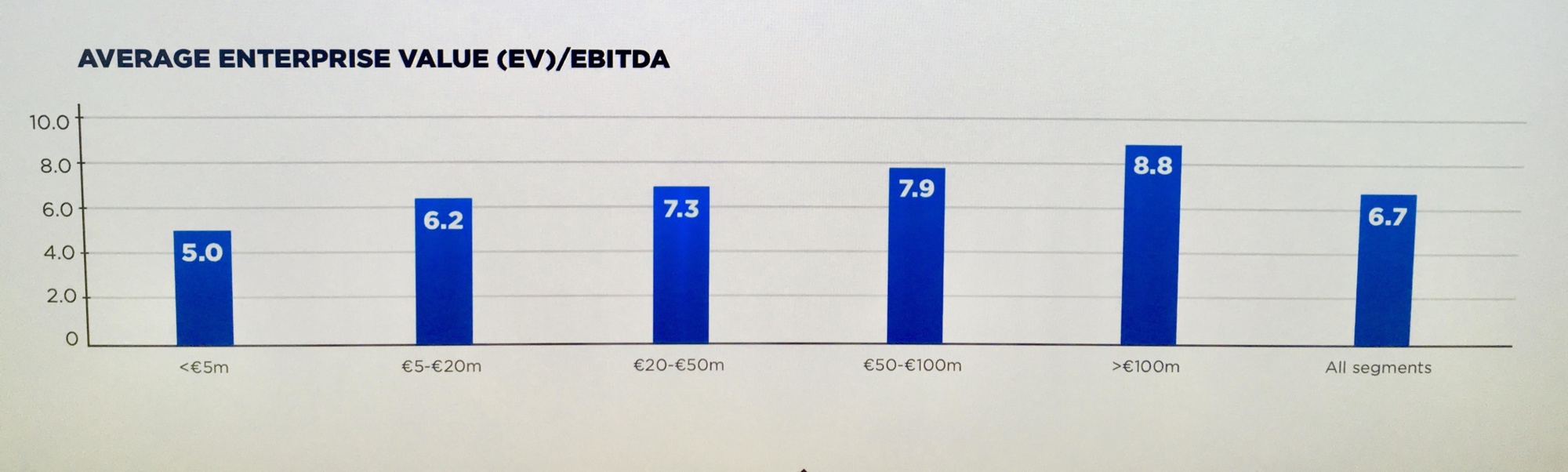

While a couple of years ago, on average 5 times EBITDA was paid for an acquisiton, this evolved to 6,7 times in 2017. Remarkably, this year’s surge in multiples is also visible in the smallest deal segment (< 5 miljoen euro), reaching a level of 5.0 for the first time.

In 2018 a new increase is expected.

In addition, a strong increase of debt financing was noted, while the % own capital share in an acquisition further decreased: the bank have ongoing optimism in current M&A transactions.

Source: Vlerick Business School, M&A Monitor 2018